What is TCFD and how did it start?

Being yet another acronym, TCFD can sound like something overly complicated, but we want to demystify this and help you to understand, comply and use it to drive sustainable action in your organisation.

The history of TCFD

- In 2015, the G20 intergovernmental forum called on the Financial Stability Board (FSB) to determine if climate change could pose a risk to the financial system.

- The FSB concluded that companies were systematically underreporting risks they face from climate change.

- In response, the Task Force on Climate-related Financial Disclosures (TCFD) was created to improve and increase reporting of climate-related financial information.

- In 2017, the TCFD released climate-related financial disclosure recommendations designed to help companies provide better information to support market transparency and more informed capital allocation.

- The task force was formed of large banks, insurance companies, asset managers, pension funds, large non-financial companies, accounting and consultancy firms, and credit rating agencies.

Since then, more task forces have been created such as the Task Force on Nature-related Financial Disclosures (TNFD), and those newly in development – such as the Task Force on Inequality and Social-related Financial Disclosure (TISFD).

TCFD reporting UK: compliance now mandatory

TCFD has been enshrined in UK legislation, and it is mandatory for organisations with over 500 employees and over £500 million in revenue to align their disclosures with the framework.

Disclosure requirements also fall under the Companies (Strategic Report) Climate-related Financial Disclosure Regulations 2022 and the Limited Liability Partnerships Climate-related Financial Disclosure (CFD) Regulations 2022.

The regulations in the UK were made on 17 January 2022 and apply to reporting for financial years starting on or after 6 April 2022. TCFD reporting requirements in the UK ensure that large companies and financial institutions disclose information on how they assess and manage climate-related risks and opportunities.

Other countries have TCFD as part of their reporting obligations, including Brazil, countries in the EU, Hong Kong, Japan, New Zealand, Singapore, and Switzerland.

In 2023, the International Financial Reporting Standards Foundation (IFRS) took on the monitoring role of TCFD disclosure as part of its International Sustainability Standards Board (ISSB) remit, shortly after the release of the IFRS S1 and S2 sustainability standards. The currently voluntary standards S1 and S2 have their foundations in TCFD and are likely to come into legislation in the future.

The 4 pillars of TCFD

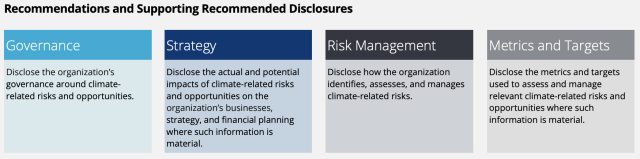

At a very high level, the TCFD recommendations include disclosures against the four main pillars of: Governance, Strategy, Risk management, Metrics and Targets.

- Governance: Disclosure of the organisation’s governance around climate-related risks and opportunities.

2. Strategy: Disclosure of the actual and potential impacts of climate-related risks and opportunities on the organisation’s businesses, strategy, and financial planning.

3. Risk Management: Disclosure of how the organisation identifies, assesses, and manages climate-related risks.

4. Metrics and Targets: Disclosure of the metrics and targets used to assess and manage relevant climate-related risks and opportunities.

Read more about the TCFD’s recommended disclosures on the original TCFD website.

TCFD terminology

Often the barrier to understanding how to respond to TCFD recommendations is the terminology.

For example, the terms ‘physical’ and ‘transitional’ risks and opportunities are used a lot in TCFD.

Physical Risk

Physical risk refers to the physical effects of climate change such as extreme weather events like flooding, drought, sea level rise, and heat stress. These can lead to financial impacts on an organisation, such as production or operational disruptions, supply chain disruptions, physical damage to assets, and rising insurance costs.

Transition Risks

Transition risks refer to risks that come about due to changes associated with the transition to the lower carbon economy. Such risks include policy changes, market, and technology changes. Some transition impacts can actually lead to opportunities for the business, i.e. changes in technology may mean efficiencies in energy use. However, other changes such as policy implementation may lead to higher operational costs, reputational impact, and changes in demand for products and services.

How organisations should approach TCFD reporting

As this disclosure is public, it should involve the very highest level in the organisation; therefore, C-suite staff should be involved in understanding TCFD, what disclosures are required, how the organisation is able to respond, and how this may change over time. A sticking point is often the terminology as well as understanding what ‘quantitative scenario analysis’ is. TCFD scenario analysis involves understanding how the risks and opportunities will manifest under different climate scenarios such as a ‘2° C’ world vs. a ‘4 ° C world’.

Other key areas to understand include the risks and opportunities, how they can be monitored and managed, assigning appropriate resources to drive progress, and ensuring disclosure is used to drive action.

How Morelli Consulting can help

At Morelli Consulting, our TCFD services include:

Educating your C-Suite and Other Key Stakeholders: Understanding the importance and details of TCFD and the disclosure process is essential for top-level management. We offer training sessions and workshops to ensure that everyone is on the same page.

Ensuring Compliance with TCFD Recommendations: We help you understand and implement the TCFD recommendations fully. This includes assistance with documentation, process changes, and strategy alignment.

Identification of Risks and Opportunities: Our team will assist in identifying the specific risks and opportunities related to climate change for your organisation. We perform qualitative scenario analysis to give a clear picture of potential future impacts.

Understanding Monitoring and Management Requirements: We guide you through current and future requirements for monitoring and managing risks and opportunities. This includes developing and tracking appropriate metrics and targets.

Creating Annual Disclosures: We support the creation of comprehensive annual disclosures that not only meet regulatory requirements but also serve as a foundation for ongoing improvements and strategic planning within your organisation.

We believe that understanding and implementing TCFD recommendations is crucial for modern organisations, not only for compliance but also for strategic advantage. As climate change continues to impact the global economy, the ability to transparently disclose climate-related financial information is becoming increasingly important and attractive for investors.

Although TCFD reporting is a legal requirement for only larger organisations at present, SMEs can also benefit and should be prepared for similar TCFD requirements, should they be made a requirement in the future.

TCFD reporting goes beyond mere compliance; it can be used as a tool by businesses for making informed decisions for long-term sustainability. With the right approach and resources, TCFD can be a powerful tool for driving positive change within your organisation.

Discover more

Please get in touch if you would like to discuss TCFD further or are looking for support from the Morelli Consulting team on your sustainability journey.

You can also explore the latest from Morelli to delve deeper into sustainability news, trends, and insights.